Connected TV is often described as the most exciting channel in digital advertising. Budgets are moving fast, audiences are highly engaged, and premium screens promise premium outcomes. But behind the growth headlines, CTV carries a problem that is quietly becoming impossible to ignore. Transparency in CTV is not improving at the same pace as spend, and that gap is putting advertisers, publishers, and platforms at risk.

Recent industry analysis has highlighted a surprising comparison: in many cases, YouTube offers more clarity around delivery, placement, and measurement than the broader CTV ecosystem. That should be alarming. CTV was supposed to represent the future of premium, brand-safe advertising. Instead, too much of it still operates in the dark.

At Afront, we believe transparency is not a “nice to have.” It is the foundation of performance, trust, and sustainable growth. When transparency fails, efficiency breaks down, costs rise, and confidence disappears.

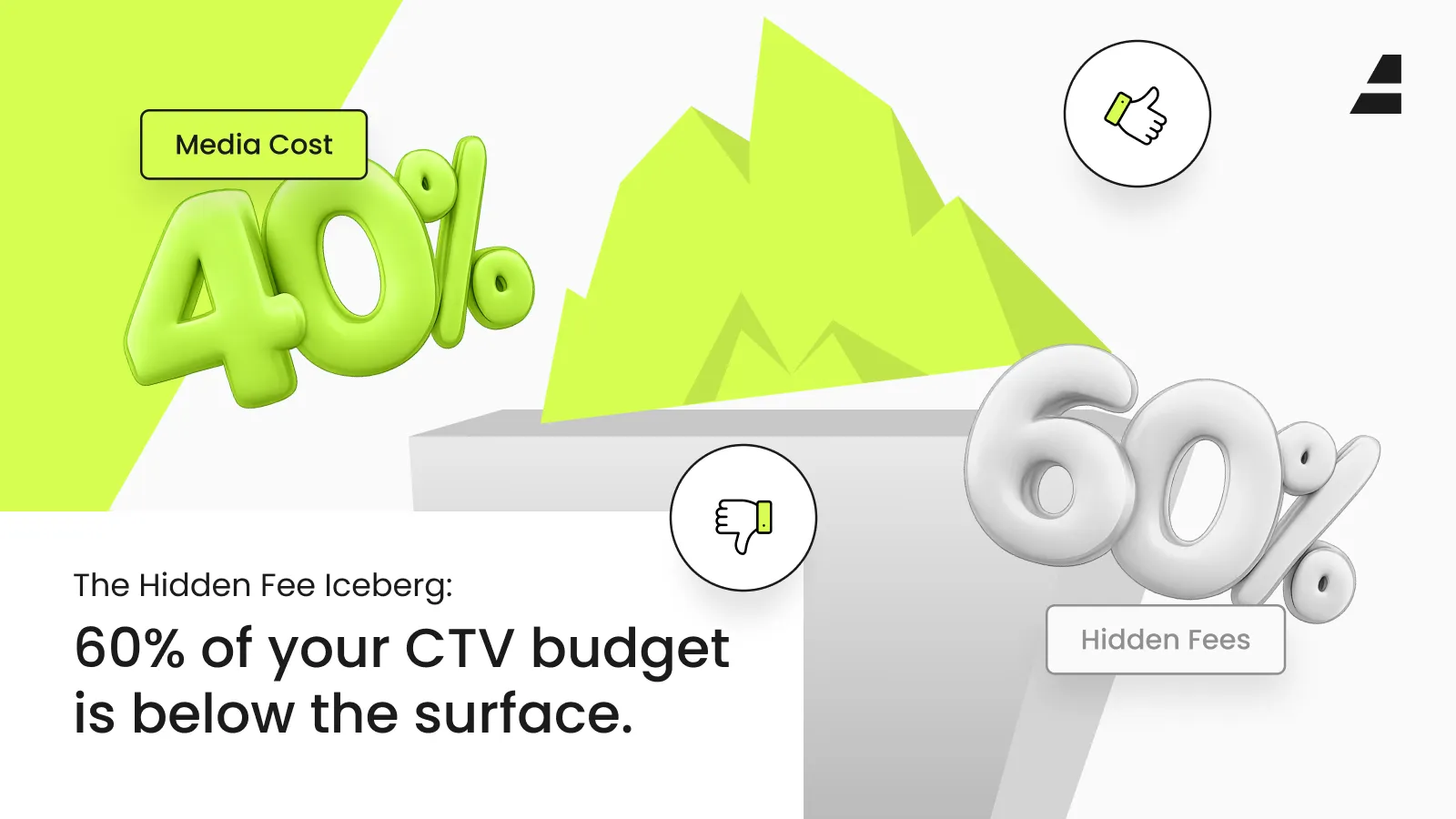

The Hidden Cost of CTV’s Black Box

CTV programmatic black box problem: Advertisers invest without full transaction visibility.

CTV’s biggest strength is also its weakness. The ecosystem is fragmented across platforms, apps, devices, SSPs, and intermediaries. Each layer adds complexity, and with complexity comes opacity. Advertisers often struggle to answer basic questions about where ads ran, how many times the same household was exposed, or whether impressions were truly viewable and fraud-free.

This lack of clarity creates a dangerous illusion of performance. Campaigns may show strong reach numbers while hiding duplicated impressions, resold inventory, or inflated CPMs caused by inefficient supply paths. Without clean data and clear reporting, optimization becomes guesswork rather than strategy.

For publishers, the risk is just as real. When inventory is bundled, resold, or poorly labeled, premium content loses its value. Yield may look acceptable in the short term, but long-term trust with buyers erodes. Once advertisers lose confidence in CTV measurement, budgets become unstable, even for high-quality publishers.

60% of CTV advertising spend wasted on non-transparent supply paths.

Why Transparency Matters More in CTV Than Anywhere Else

CTV sits at the intersection of branding and performance. It carries the expectations of television with the accountability of digital. That combination raises the stakes. Brands expect premium environments, controlled frequency, and accurate attribution. When those expectations are not met, disappointment is amplified.

Unlike open web display, CTV impressions are expensive. Every wasted impression matters. Every unclear signal makes optimization harder. And every missing data point reduces confidence in future investment. Transparency is no longer about compliance; it is about protecting the channel’s credibility.

This is why smart DSPs and publishers are shifting their focus. The goal is no longer to push more CTV volume into the market, but to make every impression traceable, verifiable, and accountable.

How Smart DSPs Are Responding

DSPs play a critical role in fixing CTV’s transparency problem. The most forward-thinking platforms are redesigning their approach to supply, data, and measurement. They are prioritizing direct integrations, reducing unnecessary hops, and rejecting inventory that cannot clearly prove its origin or value.

CTV transparency solution: DSPs and Publishers must leverage Log-Level Data, Sellers.Json, and OBS to improve supply path clarity.

At Afront, we build programmatic strategies around audience validation rather than impression inflation. Our technology focuses on precision, not noise. By using advanced targeting, real-time optimization, and clean supply connections, we help advertisers understand not just how many impressions they bought, but who they reached, where they appeared, and why performance improved.

Transparency also means visibility into results. Afront’s real-time dashboards and clear metrics allow advertisers to see exactly how campaigns perform across CTV, video, display, and mobile. No fuzzy math. No hidden layers. Just actionable insight.

What Publishers Must Do to Protect Value

Publishers are not passive players in this shift. Premium publishers who invest in transparency are already separating themselves from the rest of the market. Clean integrations, accurate metadata, and responsible inventory management signal quality to buyers long before a bid is placed.

Publishers that control their supply paths, avoid excessive reselling, and work with partners who value clarity gain stronger demand and more stable pricing. Afront supports publishers by connecting them directly with verified advertisers through transparent programmatic frameworks. This approach protects user experience while maximizing long-term yield.

Transparency is also about trust with audiences. Slow loads, repetitive ads, and intrusive formats drive viewers away. When users disengage, inventory loses value. A transparent, user-first approach protects not just revenue, but reputation.

Transparency as a Competitive Advantage

The industry is reaching a turning point. As budgets tighten and scrutiny increases, advertisers are asking tougher questions. DSPs and publishers that cannot answer them clearly will struggle. Those that can will win.

Transparency reduces wasted spend, improves performance predictability, and strengthens relationships across the ecosystem. It allows advertisers to invest with confidence and publishers to monetize with integrity. In a crowded CTV market, clarity becomes a differentiator.

If this shift sounds familiar, it connects directly to a broader trend shaping programmatic today. In our article “Data-Efficiency Over Data-Volume: How Smarter Buying of Audiences Can Cut CPMs and Boost Performance”, we explored how data efficiency is replacing data volume as the key to performance. Understanding how smarter data use drives better outcomes is a natural next step in solving CTV’s transparency challenge.

Where Afront Fits In

Afront was built to operate at the forefront of programmatic change. We empower advertisers and publishers to move beyond surface-level metrics and build strategies rooted in precision, transparency, and performance.

Our platform reaches over 300 million unique users, delivers more than 2 billion impressions monthly, and connects partners across 150+ countries. But scale is not the story. What matters is how that scale is managed. With advanced targeting, omnichannel reach, real-time optimization, and full transparency, Afront ensures that CTV campaigns don’t just look good on reports — they actually work.

For advertisers, that means cleaner reach, smarter frequency, and measurable outcomes. For publishers, it means premium demand, better yield intelligence, and sustainable growth without compromising user experience.

The Future of CTV Depends on Clarity

CTV will continue to grow. That is not in question. What is still being decided is whether it grows as a trusted, high-performance channel or becomes another opaque ecosystem plagued by inefficiency.

The answer lies with the choices DSPs and publishers make today. Transparency is not slowing CTV down. It is the only way to protect its future.

If you’re ready to bring clarity, control, and confidence to your CTV strategy, Afront is ready to help. Let’s bring your brand to the front.